Author:

Author:

Warren Heaps – Birches Group LLC

It’s getting near to the time of year when companies start to draw up budgets for next year. One of the most important numbers in the exercise is how much to budget for growth on the salary line. Some organizations assume that making an assumption for salary growth globally based on the figures used in the headquarters country is a good solution. After all, it’s easy to just take one number and apply it around the world. Such an approach, however, is flawed.

Just as Chuck Csizmar explained in his recent post about comparing salaries across different countries by converting currencies, global salary budgeting needs to be done country-by-country, and taking a shortcut like the one described above is a recipe for disaster. Here’s why.

Market Movement Varies by Country

The primary information used by HR and finance to determine salary budgets is market movement (this is a measure of how much salaries increase from one year to the next, usually from surveys) and internal economic assumptions (basically, how much can the company afford?).

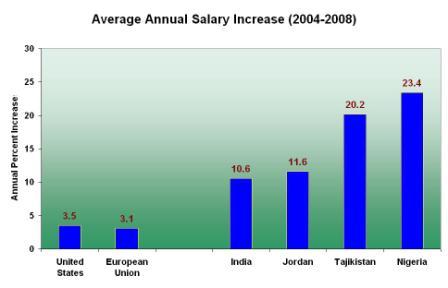

Suppose your US-headquartered company decided to apply the US salary increase percentage to all of your markets overseas for a five-year period. The graph below compares the average increases over the five-year period ending in 2008 for selected markets.

As you can see, the average increase amounts vary a lot by market. The difference compared to the US ranges from 7.1% (India) to almost 20% (Nigeria). At the same time, the average in Europe is below that of the US. And that’s just comparing the averages for one year. If you looked at the cumulative effects with compounding over the five-year period, the differences grow dramatically.

OK, I get it. I need data for each market. I’ll just use inflation.

Inflation data is fairly easy to get on a global basis. You can usually find it for free on various websites, and your local finance folks will certainly have some figures for you to use as well. They use inflation to budget price increases for your products and to anticipate the impact of price increases in raw materials and other costs of doing business for the upcoming year. And of course, official inflation figures are produced by the government of each country in an unbiased and apolitical fashion, right? But what does inflation, or cost-of-living, have to do with salaries?

Cost of Labor is What Matters!

Setting salaries is affected by many factors. The absolute level of pay is certainly influenced by cost of living – countries with higher costs tend to have correspondingly higher salary levels. But the main factor affecting salary increases – the one that drives the market movement each year – is an old rule from Economics 101. Three words. Supply and Demand. If you are recruiting for positions with hot skills, for example, and there is a shortage of these skills in the market, don’t you end up paying more for these recruits? If there is high unemployment or an excess of qualified candidates, and positions are easy to fill, isn’t there considerably less pressure to raise salary levels?

Can I just use devaluation instead?

Short answer? Nope. Local employees are paid salaries set in local currency, and obtain their everyday good and services in the local market, in local currency. Devaluation (or revaluation) defines the relationships between the currencies of different countries, usually with a reference to a “strong” currency such as US Dollars, Euros, Pounds Sterling or Yen. Exchange rate changes do affect the price of goods, for example, especially imports or imported raw materials. But these fluctuations do not fundamentally affect the cost of labor in a country. Remember, also, exchange rates are sometimes controlled by governments to achieve other objectives. Hardly a reliable measure of anything, really.

The Best Approach

To estimate your salary budget properly, you need to obtain data for market movement in each country, and analyze it in the context of your own organization’s situation (market position, health of the business, funds available for increases, etc.). There are many sources for market data – everyone has their favorites (hopefully some of you are using Birches Group data). And then you have to apply something no statistic or consultant can provide – your own judgment – to determine the right figure to use in your company. Interpretation and analysis of the data and applying it to your company’s situation is the art of compensation rather than the science.

More About Warren

Developing Markets Compensation and Benefits Group in LinkedIn

4 responses to “Global Salary Budgeting – Smart Approach or Misguided Shortcut?”